Introduction

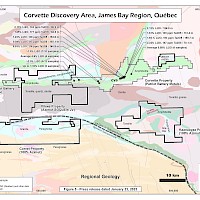

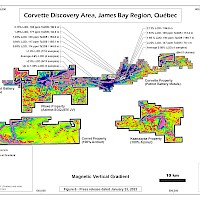

The Corvet property lies immediately south of the Company’s Pikwa property, near the Trans-Taiga Road, a nearly 600-km-long gravel highway running east-west through the James Bay region. It is 55 km southwest of the La Grande-4 airstrip and 225 km east-southeast of Radisson. The property straddles a major tectonic boundary and displays a strong multi-element (Ag-As-Bi-Cu-Sb) spatial association in lake-bottom sediments. The property also covers an outstanding lithium exploration target represented by a prominent 26-km-long Li anomaly in lake-bottom sediment coupled with strong Rb, Cs, Ga and Sn footprints. The property occupies a strategic location relative to the emerging Corvette (Patriot Battery Metals) lithium district.

In July 2023, Azimut announced the signing of an option to joint venture agreement with Rio Tinto Exploration Canada Inc ("Rio Tinto"). Rio Tinto can acquire an initial 50% interest on the property from Azimut over 4 years by funding $7 million in exploration expenditures and by making cash payments totalling $850,000. Rio Tinto can earn an additional 20% interest over 5 years with further work expenditures of $50 million. Azimut holds the right, should it choose, to be funded to production by way of secured loan from Rio Tinto by granting Rio Tinto an additional 5% interest in the property (for a total interest of 75%). Azimut will be the operator during the first option phase and Rio Tinto will be operator during the second option phase.